在澳洲,哪一种商业模式最适合创业的你?| 澳法评

关于此文的更多问题,欢迎联系小编获得更多资讯:Auslawreview01,获得澳洲(昆士兰州布里斯班)华人律师团队的法律建议。

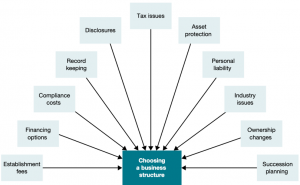

作为创业者,选择最适合的商业组织形式是事业起步之初,最重要的一个决定。该决定取决于你创业的模式,性质以及许多的其他因素。

下面列举了一些,你可能需要考虑的因素:

1) 该企业将从事哪些活动?

2) 设置费用是多少?

3) 如何筹集资金以发展业务?

4) 符合监管义务的成本是多少?

5) 企业需要保留哪些记录?

6) 业务需要向监管机构做出哪些披露?

7) 纳税的优点和缺点是什么?

8) 个人和公司资产可以受到保护吗?

9) 所有者和管理者将承担哪些个人法律责任?

10) 商业或行业的类型是否会影响商业模式?

• 企业和个人是相同的,两者是无法区分的。

• 个体经营者拥有并控制自己的业务。

• 通常用于小型企业(例如水管工,杂工,牙医等)。

• 合伙的必备要素:

• “开展业务”

• “共同的”

• “为了获利”

• 合伙人数目:一般限于20个。

• 没有独立的法律实体。

• 建立合伙关系本质上是契约性的。可以正式或非正式地建立伙伴关系。

• 合作伙伴彼此之间应负有忠实的信托义务。

• 所有权权益不能自由转让。

• 可以起诉并被起诉。

• 可以拥有财产。

• 有永久的继承权。

• 股东的责任是有限的(即有限责任的概念)。

• 涉及以下实体/团体的法律关系复杂:公司本身,与公司打交道的第三方,发起人,董事和成员。

想要了解哪种商业模式更适合您的生意,请加工作微信auslawreivew02进行咨询。

Here are some factors you may need to consider:

1) What activities will the business undertake?

2) How much will the business cost to setup?

3) How can funds be raised to grow the business?

4) What are the ongoing costs to comply with regulatory obligations?

5) What records will the business need to keep?

6) What disclosures will the business need to make to the regulators?

7) What are the tax advantages and disadvantages?

8) Can personal and business as sets be protected?

9) What personal legal liability will the owners and managers have?

10) Does the type of business or industry affect the business structure?

• The business and the individual are the same — they are indistinguishable.

• A sole trader owns and controls his or her own business.

• Typically used for small enterprises (e.g. plumber, handyman, dentist etc.).

• Elements:

– “carrying on a business”

– “in common”

– “with a view to profit”

• Number of partners: generally limited to 20. See Corps Act s 115.

• Not a separate legal entity.

• The creation of a partnership is contractual in nature. Partnerships can be created formally or informally.

• Partners owe each other fiduciary duties of loyalty, etc.

• Ownership interests not freely transferable.

They can sue and be sued.

• They can own property.

• They have perpetual succession.

• Shareholders’ liability is limited (i.e., The concept of limited liability).

• There are complex legal relationships involving the following entities/groups: the company itself, third parties who deal with the company, promoters, directors and members.

If you want to more information about business structure, please add WeChat account:auslawreivew02 for consultation.